|

Science Behind an Effective Pay

Plan

A Philosophical

and Historical Perspective of Compensation Strategy

by Mike Akins

The following

is an expository on the company compensation program and pay plan. During my career of more than three decades, I have found

that the majority of networkers do not understand the dynamics of compensation programs. This is not a reflection of

the individual's intelligence level but is due to the lack of statistical information available in our industry. I

employ a staff of statisticians who compile data for my use in marketing strategies. In order for you to understand the significance

of each feature in the company compensation program, I have included in this analysis an overview of industrial statistics,

marketing trends, historical precedents, the effect of present and past marketing philosophies, along with the fundamental

principles by which our industry functions. Only when you understand the dynamics that control results in this industry,

can you measure a pay plan effectively.

In order

to understand the merits of the company compensation program, you will need to understand the dynamics of "true" network marketing.

There are market forces and business principles that determine what works in this industry. Sometimes these factors

are not obvious but very subtle. For an example, our surveys revealed that, in the past 2-3 years, more than 2 million networkers

have been victims of failed network marketing programs. They were working against factors that they did not fully understand.

During this period, another 2 million have switched programs. A majority of these programs were flawed from their beginnings.

A great number of these individuals have repetitively made the same mistake in their selection. They simply do not have a

complete picture of what to look for in a viable program. Our research discovered that a number of these individuals left

viable (good) programs because they didn't know how to recognize or how to work a viable program. Again this is not due to

a lack of intelligence or skills on the behalf of the distributor, but the lack of statistical information and "trade specific"

training.

During my first eight years of network marketing I suffered

from identical circumstances. Repetitively, I would build only to lose. I was literally spinning my wheels. In this synopsis,

I will share what I have learned during my successful career of more than three decades in this industry. Also, I will share

information that I have obtained from Research & Marketing Consultants and ABM Marketing, which are statistically based

conventional firms that I own. These firms have studied the network marketing industry extensively. Recently, these firms

completed a study of more than 300 programs. Marketing trends, attrition factors, compensation strategies, product

philosophies, support strategies, growth patterns and many other issues were carefully researched. Now you, the networker,

can have the same statistical support that other industries have enjoyed for years.

Generally, when

a networker analyzes a program's potential to produce compensation, they look to the pay plan. In reality, it requires more

than a theoretically lucrative pay plan in order to produce adequate compensation. In network marketing, the equation for

success contains several factors. The pay plan is one of these factors. Each of these factors influences the effectiveness

of the other factors. For example, a great pay plan may not produce great paychecks because of inferior products or ineffective

marketing systems and strategies. A great product line may never produce great sales due to poor marketing strategies or lack

of pay incentives. A program with both quality products and a lucrative pay plan may fail to "fly" because of the company's

failure to keep up with the growth and provide quality service. A program can have certain strengths but contain weaknesses

that attract the wrong type of networker, causing stagnation and excessive attrition. A pay plan may be imbalanced, awarding

one segment of networkers at the expense of another.

The

purpose of this expository is to share general information on the dynamics of compensation and specific information on the

potential of the company program to produce compensation. I believe that the company pay plan is in the top 5% of pay plans

in the industry and is potentially the number one compensation producing opportunity in the industry. In order to capture

the full potential of this opportunity, there are certain dynamics you must be aware of that affect the ability of the program

to produce compensation for a broad base of its members.

In order

to determine the potential of a program to produce income you must understand the difference between a compensation plan and

a pay plan. A "paper" pay plan is primarily a schedule through which commissions and bonuses are theoretically paid. A

compensation program includes all factors that produce actual compensation. There are several factors that are important

to a program's potential to produce income that are not included in a pay plan. For example, a "hot" product or a toll-free

hotline may make it easier for distributors to enroll a greater number of prospects. These factors would be considered compensation

factors but not pay plan factors. You cannot determine the real potential of a program to generate income without understanding

the concepts and principles upon which the industry is founded. Your understanding of these fundamental principles will

affect the criteria by which you select a program and judge its potential. These factors determine which features will affect

actual compensation. Also, your marketing philosophy will affect your marketing strategy as well as influence your stamina,

which is vital to long-term success.

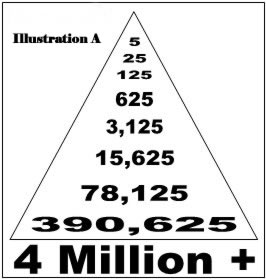

A pillar to success in network marketing is the geometric

growth factor. Understanding the principles that relate to geometric growth will assist you in selecting a viable program

and structuring your organization for long-term success. Because of the geometric growth factor, it is important to attract

a combination of the right types of networkers into your organization and place them correctly. This principle is called

tier structuring. I will expound on this principle later in this synopsis. One of these tiers consists of the end product

users. There must be individuals who are primarily interested in using the product, who are not interested in earning income

through the product. Without tier structuring, your program or organization is destined to fail in spite of how brilliant

you may be.

In order to understand

this principle explicitly, consider the following example: If you follow the geometric growth of a 500,000 member organization,

you will find that approximately 390,000 of these total distributors will be on the bottom level (see illustration A). In

traditionally structured programs, it requires at least 10-15 individuals purchasing product (equal to the qualifying dollar

amount) in order for one distributor to break even on their personal qualifying purchase and get into profit. In the highest

paying programs it will still require at least 4-6 purchasers. With either of these extreme approaches, there will always

be from 75-90% of all distributors not breaking even on personal qualifying purchases or earning a profit. It is vital to

your success to understand this principle. Failure to address this issue has been a major reason that a number of leaders

in the industry have not been able to maintain a consistent degree of success. They are always in a rebuilding mode.

The difference between the

number of distributors earning a profit in the best paying program and the worst paying program is only about 15-20%. At

best, only 25% of your distributors will be earning a profit or breaking even on their qualifying product purchases. What

are the other 75% going to do? If they are networkers involved to make a profit, they will drop out. You cannot escape

this ratio. This dynamic is a foundational principle built into the very concept of network marketing. There has to be

end users who are not earning an income. The program that you are involved with has to be able to attract non-income earners.

In illustration A, in order for the 390,000 distributors to break even or earn a profit, they will have to find from 1˝ million

to 4 million new purchasers. Can you imagine what the requirements for the next level will be? A program will begin to unwind

from the bottom up when they reach this theoretical threshold illustrated above. Actually, this principle affects the unwinding

process very early in the building process. If you never understand anything else, it is vital to your success that you comprehend

this principle. In order for one person to break even or make a profit, there must be 4-6 people who do not! Write this down

on paper. Work through the figure over and over again, until you capture a vision of what I am sharing with you. This factor

must be considered when selecting a program.

The unwinding process can

begin before an organization reaches this size. Small organizations of only a few hundred or a few thousand can experience

the unwinding process as they build. There are many factors that affect the growth and stability of an organization. These

forces are affecting the growth process from the beginning stages. Only when a majority of these factors work in unison,

can an organization experience solid growth that will last. Many times what creates explosive growth initially will be

the very factor that creates excessive attrition later. Certain strategies attract certain types of individuals. The type

of individuals your program attracts will, in part, determine the long-term attrition and retention rates. It is not a matter

of "good" or "bad" people. It is a matter of certain "mindsets" that respond to certain factors in a program. The features

that stand out in a program or that you primarily promote will attract networkers who value those particular features.

Each distributor's paradigm toward network marketing is shaped by their personal experiences, skill level, work habits, expectations,

personality traits, and their perspectives that have been influenced by the information they have been exposed to. This paradigm

will affect their performance and determine their value to your success. In emphasizing the wrong features, or selecting a

program that has misplaced priorities, you may attract an imbalance of a particular type of networker who will predispose

your organization to failure or a high attrition rate.

is important

for a network marketing organization to contain a balance of tier participants as well as a balance of the different types

of individuals. You can control this balance by selecting the right program, with the right features, and by promoting these

features correctly. A great number of networkers waste a tremendous amount of time promoting programs and features that

will defeat them in the long run. You can overly promote a positive feature and create the wrong expectations in your

distributors. For example, you may overly promote a system that could have been a support to the efforts of the marketer.

By over-emphasizing the system, the marketer fails to develop his skills because he depends on the system or support to

create success for him. You can overpromote a pay plan to the point that the marketer has unrealistic financial expectations.

The marketer may drop out because of these expectations, whereas, he may have stayed in the program and achieved success if

the program was promoted correctly.

The right program

promoted correctly will naturally build a strong organization. First, the program should have organizers, strategists, and foundational members. These

individuals influence overall company direction and strategy. Secondly, there must be senior and junior leaders who are the

"movers and shakers." These leaders provide "in the field" leadership and motivation. Next come the moderately experienced

networkers and part-timers that represent a broad range of income requirements from a few hundred dollars to a few thousand

dollars per month. This tier of marketers will actually do the majority of the sponsoring. Each will only enroll a few new

distributors, but as a group the numbers are significant. Other tiers will include product users, hobby enthusiasts, and customers

who are involved just for quality products or the social aspect. This group will be the product user base for the income earners

and should be the largest segment. The product user base, individuals who are either low or non-income earners, must constitute

at least 75% of your organization or eventually excess attrition will occur. This is based on the principle explained

in illustration A. Only when your organization contains all of these tiers do you have a secure residual income.

It doesn't matter

how lucrative the pay plan is, there must be a majority of individuals in the marketing structure that are primarily product

users. In examining illustration A, you can understand the need for this. These product users can be customers or members

who are primarily in the program to purchase the product at wholesale. A viable program must be able to attract product users

in order to create long-term compensation for the networker. The dynamics of a pay plan will not have a profound effect on

attracting or retaining these product users because they are primarily product-minded and not focused on income. Actually,

a program that is promoted primarily for the pay plan will have a difficult time attracting product users. When the money

is the main issue, earning expectations are higher. For the 80-90% who will be at the bottom of the matrix, these expectations

will result in discouragement and attrition. When a balance of features are promoted, "casual" part-time distributors that

may not, for a number of reasons, be "destined" to earn much income will stay as product users. The product line and service

will be the key factors in attracting and retaining product users. Also, the quality of service and a simple, "problem free"

ordering system will accommodate the retention of these product users. Designing the appropriate product and service strategies

is vital to a tier structured organization.

All of the "giants"

in the industry have been built according to the "tier structured" philosophy. That is why they have survived in spite of poor pay plans. Amway has

3 million distributors worldwide. With one of the worst pay plans in the industry, they have maintained a distributor base

of 2-3 million distributors for several years. How? There are many tiers of participants. Shaklee, Forever Living, NuSkin,

and HerbaLife are all billion-dollar companies, and each has developed on a tier structure of participants. Until you understand

this concept, you will not be able to develop strategy that will produce long-term results. Companies that have primarily

promoted the pay plan as the main commodity do not understand the basic principles upon which network marketing is based.

This is why they are not doing so well in the arena of competition. The pay plan is important, but it is only one of several

factors involved in producing maximum compensation and retention.

The purpose of pyramiding

laws is to protect innocent distributors from the consequences of the mathematical realities involved in geometric

growth. Legislators realize that you cannot build a secure networking business on only networkers who are each expecting to

earn an income. Legislators call this structure a "house of cards," which will collapse under its own weight. That is why

there must be end users who are not involved for an income. Just as in a conventional business, where you have general managers,

department managers, staff members, foremen, common laborers, and customers, in network marketing you must have various tiers

of marketers and product users. Network marketing will not function effectively any other way. Eventually, individuals

at the bottom of the pyramid will drop out initiating the unwinding process that will work its way up to the upper levels

of the structure.

As I shared

earlier, the equation for success contains several factors. The percentage of distributors who will achieve success in

any particular program is determined by these factors. A few of these factors include the security of the company, the

paradigm of the company leaders toward their distributors and the industry, effective marketing and compensation strategies,

the product philosophy, the potential of the products to retain product users, the support tools in place that accommodate

the "grassroots" networker (who may have limited experience and time), the type of training available and, of course, the

degree of personal effort invested by the networker (this can be influenced by what you promote). The strategic balance

of these factors will determine the amount of compensation produced by a program.

Company leaders must proportion

the proceeds between the various areas of operation. They must balance their investment between the following: the products,

packaging and marketing materials, product research & development, management salaries, salaries of service and support

personnel, investment returns, facility, equipment, commissions to distributors, and marketing support systems such as toll-free

hotlines, and Internet tools. A strategic balance of these investments is vital to long-term success. You must invest

in quality corporate leadership that can create the right strategies and provide the visionary leadership that will be best

for the overall opportunity. At the same time, the company must invest enough money into the compensation plan so marketers

can earn incomes that are competitive at various levels with programs within the same marketing arena. The competitive issue

here is not the theoretical pay plan but the actual incomes earned at various levels within the distributorship.

The pay plan

is one of the factors involved in producing compensation. There are two fundamental aspects of a pay plan that determine its effectiveness. First,

you have the structure of the pay plan. The breakaway, binary, matrix, Australian two-up, multiple phase, and the uni-level

are examples of the different pay structures available in the industry. Secondly, how the bonuses are appropriately placed

throughout these structures is important. Each of these structures have features that favor the heavy hitter, the company,

or the part-timer. Pay structures that balance the potential commissions between these three categories provide a more secure

income for all three. Traditionally, pay structures have favored the company and a few heavy hitters. Gradually, network marketing

is maturing and a number of programs are providing a better balance between these segments. In my personal opinion, I believe

the uni-level provides the greatest opportunity and balance for the majority of its participants. I will thoroughly expound

on the different pay structures in another expository at a later date.

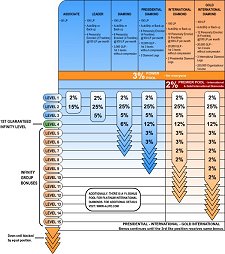

When reviewing pay

plans, look for balance.

An effective pay plan should place a significant percentage of bonuses on the first two levels to support the less experienced

part-timer. A significant percentage of the commissions should be placed on the next couple of levels and into the infinity

bonuses to adequately compensate the moderate part-time to full-time marketer. There must be deeply penetrating bonuses to

sufficiently compensate the leaders. The bonuses at the beginners' levels should be easier to reach, while the bonuses at

higher levels must be protected by qualifications that restrict the number of individuals that can obtain them. If higher

levels are too easily reached, the experienced networker will be blocked from deep penetration and will migrate to another

program. Balance is the key to overall success. Imbalanced programs lead to attrition and failure. If too much money

is placed at the beginning levels, the program will attract an imbalance of inexperienced networkers. Without a sizable number

of experienced leaders who have previously achieved success, your organization will be weak. The marketing strategies and

training skills they bring to the program can be very important.

The largest

segment of part-timers and the least experienced networkers will benefit more from the first two levels. Within our industry,

there is a wide range of payout on these levels. Traditional programs generally pay 5-10% per level on these levels. Recently,

"compressed" pay plans have appeared in the market paying 15-50% on the first two levels. There are serious drawbacks to each

of these extreme positions. Smaller percentages up front create an unfavorable break-even ratio. Placing too much money in

the first two levels will attract a greater number of networkers who are more likely to drop out. Secondly, examine how many

levels are guaranteed. Traditional programs guarantee 5-7 levels. A program that guarantees more levels generally will pay

less per level. This will create a poor break-even ratio that can lead to higher attrition. Programs that pay too much

on the first couple of levels, generally include appropriate "breakage" and BV factors that disguise the true payout. These

programs "steal back" the misplaced percentages from other levels within the pay plan. The most effective pay plans will

balance the first two levels with deeper levels. A pay plan should allow the part-timer to get into profit with 4-6 purchasers.

There must be enough income available to the experienced networker in order to attract quality leadership into the program

and produce the type of checks that will hold them.

When examining pay plans look for "breakage"

and BV features which affect true earnings. The term BV (sometimes referred to as CV, PV, and LP) ratio refers to the figure

from which you are actually paid in relationship to the actual cost of the product. The term breakage generally refers to

qualification requirements within the pay plan, which "not so obviously" affect the true payout of the program. In response

to competition, there is a trend toward offering high bonuses and then diluting these bonuses with low BV and excessive

breakage. In order to find the true bonus, divide the BV by the wholesale price. For example, a BV of $30 divided by the

wholesale cost of $40 gives you a 75% ratio. If the plan claims a 40% payout, multiply the 40% by 75% and you find that the

true payout is 30%. To discover how breakage affects true payout, find out what percentage of individuals can achieve that

bonus level. For example, if a bonus requires $50,000 volume to achieve, divide the $50,000 by the expected average purchase.

This will give you the total number of individuals required to reach that qualification. If the average purchase is $100,

in the above example, the $50,000 qualification will require 500 people to reach it. Overlap can be figured by dividing 500

by the width requirement

Once you carefully analyze

the pay plan and understand its theoretical potential, you will need to analyze the potential of other compensation features

to influence earnings and retain distributors. As I stated earlier, there are several factors other than the pay plan

that influence actual income potential. In order to clearly understand the balance between the dynamics that affect success

in network marketing, we must examine the history of our industry. History teaches us that a great majority of networkers

respond to products and other related factors before they consider the pay plan. This is a reality that must be addressed

in order to select a program that will produce residual income. Since 75% of a healthy organization will primarily be product

users, the fact that the majority of networkers are attracted to the product first is a healthy scenario. One such reality

is that products in network marketing have a tendency to cost more than products in the conventional market. In order to keep

product users, the company will have to offer unique products that are not easily duplicated in the conventional industry.

With the inevitable ratio of three out of every four networkers not breaking even on product purchases, a balanced product

and marketing strategy becomes vital to attracting enough product users to maintain success.

In reviewing

40 years of network marketing history, we find that the majority of successful programs are focused on the products and service.

Amway, Shaklee, NuSkin, and HerbaLife each have more than a million distributors and each have very poor pay plans, yet they

maintain the greatest number of active distributors. More recent "success stories," such as New Vision, Mannatech, and Morinda,

are product focused programs. Each of these three companies have exceeded all records for quick growth, enrolling more than

one-half million distributors within three years from being founded. Cell Tech and Life Plus, which were around awhile before

they "exploded," grew from 30,000 to 500,000 distributors in three years after finding a popular flagship product and an effective

marketing strategy. Both of these companies are product and service focused. All of these programs have pay plans that are

considered to be in the low to moderate-paying category. As you can see, the dynamics of growth are complex. The more you

understand about these dynamics the better you can develop strategy and select the program that will best fulfill your goals.

I am not promoting a poor pay plan, but I am using these examples to bring a sense of relativity to our perspectives.

A benefit to programs with pay plans in this

category, is that they attract individuals who seem to have a broader perspective of network marketing and will stay in a

program long enough to give it a chance to succeed. They generally do not have exaggerated expectations and know they have to learn how to work a program

to be successful. This type of networker is more likely to include product users in their recruiting efforts and interact

more with their downline, resulting in a more solid foundation. Even with poor pay plans, these nine programs have produced

more incomes and higher incomes than the "sum total" of all the other hundreds of programs in the industry. Amway alone

has produced 2200 millionaires. I agree that if they would have had more lucrative pay plans there would have been even

more successful "grassroots" distributors but, from these examples we can learn principles that can effect our futures.

These principles

must be taken into consideration when selecting a program. Pay plans do not attract the masses but are important once the

individual is involved. First, you must be able to attract the right type of prospects to your opportunity and then be able

to retain the distributors once they have joined your program. Pay plans are not the only factor that is involved in retention.

The majority of companies in the industry represent two extremes in compensation philosophies. The traditionally structured

programs place the majority of commissions outside the reach of the part-time distributor. The company and the more aggressive

networker benefit most from this imbalance. The other extreme is the "hyper compressed" pay plans. Our company represents

a middle ground between these two extremes.

Let's take a closer look at these compensation strategies

and learn from them. The traditional 5-10% paid five or six levels deep created a situation where it required 10-20 distributors

in each marketer's business to break even on qualifying purchases. Each new distributor that enrolled faced the same challenge.

Therefore, as the organization grew, the problem intensified. The result was more attrition at the "grassroots" level.

In spite of the flaws in the pay plans, these companies have produced a great amount of compensation. Because of certain other

compensation factors outside of the pay plan, these programs survived and are viable in today's markets. The company retained

enough product users and passive part-timers to support a number of successful serious networkers. These traditional companies

have been able to survive and thrive because they were product and service focused and were built on a tier structure. The

networkers with low skill levels, but with higher ambition, suffered in these programs. This is the segment that suffered

more attrition. Programs with more balance are finding more distributors at the beginning levels earning more income. A reaction to this imbalance is the compressed compensation pay

plan. In a compressed pay plan, the company places a greater percentage of the commissions within reach of the majority of

its members. Theoretically, this encourages a higher rate of retention. In order to understand the dynamics of these philosophies,

I invite you to read my synopsis, "Cold Facts Exposed." Typically, the compressed

pay plan will pay out, 30-50% (after adjustments for BV) within the first two levels. Traditional programs pay out a total

of 10-20% within the first two levels. Additional pay up front allows the part-time marketer to earn more with fewer people

in his downline. The inexperienced marketer will have more difficulty sponsoring other distributors and developing a customer

base. The first level is the least important level because you should have fewer people on your first level than on your second

and third levels. With the assistance of your first level distributors, you should have more marketers on your second level.

Occasionally, inexperienced networkers will desire more immediate income on their first level, but this is not wise. Whenever

you place more commissions on any particular level it must come from another level. It is best for the marketer to have the

commissions placed on the levels that are most likely to have more members, but still within reach of the part-timer

When compressed programs first appeared, they generally

paid 15% and 45% on the first two levels. Infinity bonuses started on the third level. Marketers were blocked too easily

in these early models and there was not enough incentive to build deep. Later models offer more guaranteed levels with

fewer blockages. Now that compressed pay plans have been around four to five years, challenges have surfaced. A majority

of companies that are using the compressed pay plans have overreacted to the traditional, flawed pay plans. Companies

that have gone too far in the compressed pay plan "paradigm switch" are experiencing slow growth and similar attrition

problems that the traditional pay plans have experienced. These companies are having difficulty attracting a great number

of experienced networkers who can bring to the company a wealth of wisdom and leadership. Many of these companies have over-invested

in the pay plans. This creates a shortage of funds, not allowing for investment in product research and development, state-of-the-art

service, competent leadership at all levels of corporate management, and effective support systems. The end result is inferior

products, a lack of innovative products, poor service, inadequate inventories, and the creation of a financial scenario that

sometimes threatens the company's survival. Our company offers a more moderately compressed program with potential for

deep penetration. It contains a better balance, allowing both the lower skilled marketer and the highly experienced leader

to benefit more evenly.

Observe

this principle at work. As I shared earlier in this synopsis, product focused companies, such as New Vision, Mannatech, Morinda,

Life Plus and Cell Tech, each grew to a distributor base of approximately 500,000+ within a period of 2 to 3 years. Each of

these programs has a very poor pay plan, averaging less than a 10% per level payout. Heritage Health, LifeForce, and Changes,

which represent "exaggerated" compressed pay plans, are growing at 1/10 the rate. LifeForce has, at one time or another,

had 80,000 distributors. In the spring of 1999 they had approximately $700,000 in monthly sales. If each active distributor

purchased from $50-$100 per month, that would translate to be only 10,000-14,000 total distributors in the company. The attrition

rate is high.

Although these

companies pay more money up front than traditional companies, they have similar attrition rates. Why? These programs place an imbalanced emphasis on income, which leads to exaggerated

expectations and excess attrition. They cannot attract, nor hold onto, the product user and other important tiers of participants

that form a solid foundation for networkers to succeed. As I have shared in this synopsis, theoretically, the majority

of participants in this industry cannot and will not earn a profit because of the geometric requirements for each individual

to earn income. In the right program, many of these participants will eventually become product users. In a program that offers

overpriced "me too" products, that can be purchased at a local discount store at lower prices, they will drop out. These

types of programs attract an imbalance of networkers who are only "income-minded" and have not developed the patience, the

understanding, or the skills (or even the willingness to develop the skills) in order to succeed in network marketing.

These networkers are looking for a pay plan or certain feature to make the difference in their success. Programs that attract

these types of marketers may produce short-range success for a few, but so far have not shown the ability to maintain that

success.

Programs that focus

on "easy money" instead of sound business principles attract a majority of individuals who are not realistic in their expectations

and do not have a realistic perception of their skill level. They will not be satisfied with the success that their skill level will produce. Generally, these programs attract

a greater number of disgruntled networkers who are skeptical and carry a low level of anger toward the industry. These

types of networkers become discouraged easily and will drop out of whatever program they select. These types of marketers

will lean on "self-propelled" systems that require very little of the individual. This approach robs the marketer of the experience

and training that is necessary for real lasting success. This segment of networkers has the highest rate of attrition in

spite of what the pay plan offers. The best approach for these networkers would be to select a program that is designed

on principles that have been proven to work over the past several decades, and learn how to market a viable program. Simply

put, "money focused" programs do not create more money for the majority of networkers or, in other words, "easy money" doesn't

come easy.

Product focused

distributors will generally stay in a program longer as they learn the "ropes" to success. Building a successful business

requires a process of personal growth, the maturing of strategy that is "program specific," cultivating the prospect market,

developing and test marketing various marketing tools that have a long-term benefit to the specific program, and the development

of a support structure that is tailored to the needs of your specific program. All of these factors are important to "real success" (success that is going to last). There is a current trend to

shop for a program that is going to "take off" for you. Sometimes the factors that create a short-term growth wave are the

very factors that destroy the "wave" later. History proves this concept to be true. During my career of more than three decades,

not one program or downline organization that has been built on the "money focus" approach has succeeded. I am in the industry

full-time to earn a very lucrative income, but I have earned this income by developing a solid organization founded on sound

business principles of being "product and service" oriented. There must be enough time allowed for a "tier structure" to develop

in your particular organization.

Aligning

your strategy with the principles of being product and service focused is a key to lasting success. Finding a true product

and service focused program can be difficult. There are three types of these companies. The first type of product focused

company is one that directs the attention of the distributors to the product, because they realize it gives their program

an image of legitimacy. The leaders believe that money is the real focus but realize that they may be perceived as being

a "money game," so they superficially promote a quality line of products or service. There is a wide range of "money focused"

programs in the industry, ranging from gifting plans, cycling plans, and one-time purchase programs to opportunities that

resemble a "true" product focused program. These types of programs do not have strong residual income potential and only produce

short-term growth.

A second type of

product focused program places emphasis on the product and service, but does not provide effective features within the program

that support the success of that type of program. Product focus does not only refer to emphasis on products. It also refers to marketing strategy that provides marketing

features, along with the products and service that support tier structured growth. The majority of the time, this type

of program is using "sizzle" product propaganda to cover up a poor pay plan. This type of program may experience initial

growth only to level off as distributors experience the dynamics of the program.

The third type of

product focused company is one that actually designs the features of the program to naturally attract product focused distributors.

These programs will have higher quality products and generally have "flagship" products that are more cutting edge and exclusive.

These companies will provide marketing tools, state-of-the-art systems, effective literature, credible endorsements, comprehensive

customer service, and other features that target tier structuring. The end result is progressive growth and lasting success

at the distributor level.

There are

a number of individuals who have tried traditional programs and failed to earn an acceptable income. These individuals have

concluded that the programs didn't pay enough. To an extent, this is true. As I mentioned, a number of traditional companies

used the product focused philosophy to hide a poor pay plan. Traditional programs have a tendency to pay too little up front.

This does make it more difficult for the start-up part-timer. On the other hand, exaggerated compressed programs have used

the "up front" philosophy to hide inferior products or a poor marketing strategy. Remember the break-even ratios that I previously

shared in this synopsis. The programs that pay the highest up front still had 75% percent of their participants unable to

break even on their qualifying purchases. The traditional programs had a "break-even ratio" of 10/90%. The difference between

the two extremes is only 20%. We still have the minimum of 75% of the distributors dealing with the profit issue. Paying more

money up front is only part of the answer. Placing too much money up front only worsens the problem as I have already explained.

The answer is a balanced marketing plan, more effective training, better support, and tier structuring, which means bringing

more product users into the program.

Even the individual who has difficulty achieving success

in network marketing can be successful under certain conditions. They should join a program during its infancy that has the

type of products and strategy that will eventually attract and retain a great number of customers and product users. These

networkers must have the type of training available that will assist them in learning to become true networkers who progressively

develop their marketing skills. Programs that are seriously flawed encourage networkers to reach for "super systems"

and "gimmicks" to compensate for the flaws. Circumventing effective training through gimmicks will spell certain doom.

Initially, these tactics will create growth. This growth will be short-lived. Systems can be helpful but cannot generate enough

enrollments to create a large number of marketers successfully. A few heavy hitters will be the only ones that benefit from

a system alone. Without a viable program and the proper training, the cluster of "well wishers" will eventually perish. Achieving

and maintaining success requires participation from a majority of its participants. Success in networking marketing is based

on teamwork. Anyone who believes they can ride a system to success without working and learning how to effectively market

it, will find that success short-lived. Downlines must be nourished and "cultivated" or they will not last. Everyone

must learn to do his or her part. Systems are tools that do not stand alone but must be designed to compliment sound business

building techniques.

Once you

understand these principles, you will know what to look for in a program. Companies that have developed marketing strategies

that address each of these factors will become giants in our industry. There has been a tendency for traditionally structured

companies to neglect the pay plan factor. This has led to unnecessary attrition of networkers who could have otherwise been

successful. Many of the large traditional companies have addressed the other factors well enough to attract these multiple

tiers of participants. There has been a need for improved pay plans. Our company is a leader in this arena without compromising

the other vital components. Companies that have overreacted to this need and placed to much money into the pay plan have

done their distributors a disservice and produced inferior overall programs. Distributors in these "hyper-compressed" programs

are experiencing difficulty in building successful organizations.

During my career of more than three decades, I have developed

organizations in both traditional programs and compressed programs. I presently have approximately 75,000 in

existing downlines. In my first nine months, I have engineered the development of a 9,000-member organization in this company.

I selected this company because I believe it has achieved a balance between the two extremes. I find that the members in my

company organization are experiencing a greater degree of success than members in the other programs, both at the "grassroots"

and leadership levels. From a percentage perspective, we have more customers and product users in the company organization.

This is a very healthy scenario. "Grassroots" distributors are sponsoring more easily and the ones that are building correctly

(tier structuring), are experiencing success. The company program is packed with compensation factors to complement the

pay plan. These compensation factors allow the distributor to "leverage" the pay plan to the maximum extent. A compensation

factor is any feature in the program that assists the marketer in generating more income. I will explain the pay plan and

how it is synchronized with compensation features that make the company program very unique and positioned to be one of the

leaders in the industry.

|